Supply chain finance (SCF) refers to a set of financing options for businesses to access working capital by using existing customer orders.

Downloads

Key Elements

- Various financing methods for companies that provide goods or services on a contract basis

- Existing customer orders are used for underwriting

- Offerings include upfront payments and selling or borrowing against receivables

Product Scorecard

- Business Stage Supported Ranging from pre-revenue/idea stage businesses (low) to mature stage/acquisition stage businesses (high)

- Cost to Entrepreneur An approximate measure of the blended short and long term costs a business may incur as a result of this capital type

- Risk for Investors Representing the downside risk in worst case scenarios of default on repayment obligations

- Potential Returns for Investors The greatest potential income an investor capital provider could earn by deploying funds with this product method

- Liquidity for Investors Ranging from lowest liquidity (capital providers wait a long time to receive repayment from their investment) to high liquidity (repayment begins immediately and is fully repaid quickly)

Overview

Supply chain finance (SCF) is an approach to financing that has been developed over centuries. It allows small businesses to access working capital in a timely fashion by using existing orders from customers. The use of SCF has been traced to Phoenicia and the Roman Empire, when farmers and merchants would obtain financing from lenders based on their future harvests, productions or shipments.

There are three distinct categories of SCF agreements: advanced payable, receivables purchase, and loans. In essence, businesses can negotiate an early payment from a customer, sell their receivables, or borrow against them.

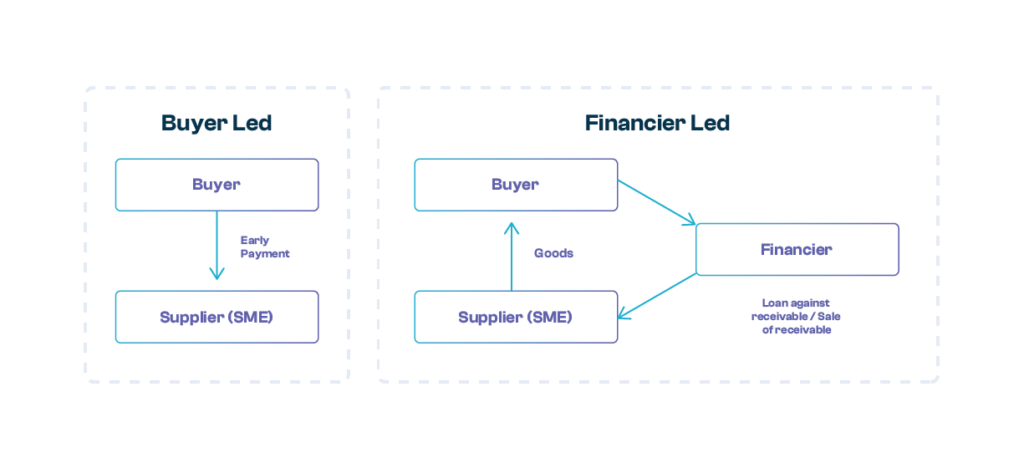

Early payment SCF transactions are “Buyer Led” i.e. buyers offering early payments to suppliers. These early payments might be discounted or the buyer will assess a fee based on how early the supplier is paid. Selling or borrowing against receivables are generally “Financier Led” transactions, where private financiers step in to provide capital and facilitate payments between buyers and suppliers.

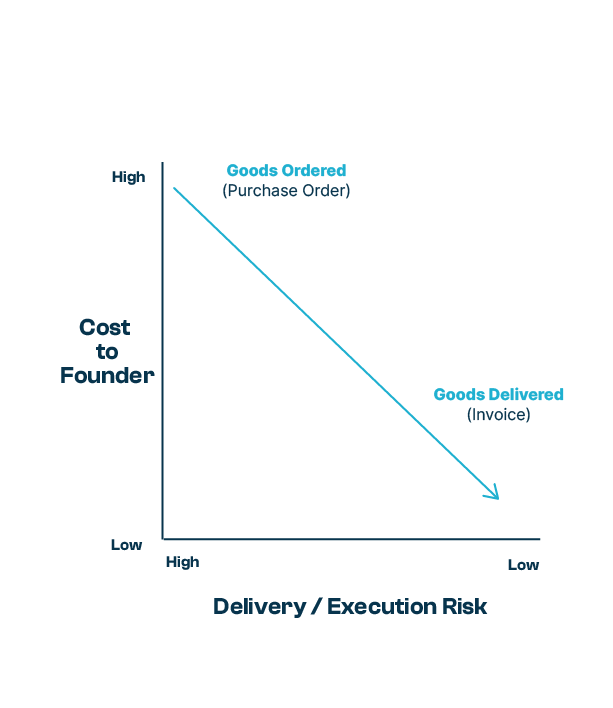

Within these categories, the timing of payments is important to the riskiness and the cost of the transactions. Payments that are made after the goods are delivered (i.e. using an invoice) are significantly less risky for buyers and financiers than payments made before goods are delivered (i.e. using a purchase order).

For financier-led approaches, if the transaction involves an invoice for goods or services that have already been delivered, the primary risk is non-payment by the buyer. If it is buyer-led, there is essentially zero risk, as the buyer has already received the goods or services and is simply paying earlier than their usual terms.

If the transaction involves a purchase order, i.e. the goods and services have yet to be delivered, the level of risk is higher for both buyer-led and financier-led SCF. This risk level should be reflected in the pricing of the SCF.

SCF often solves a problem that many large buyers do not recognize. For a supplier, a 90-day payment term upon invoicing can effectively mean up to six months of pre-financing requirements for the delivery of a service or product. Such amounts of cash can come at steep interest expenses for smaller suppliers that do not have the track record or credit history of their large buyers.

SCF can help funders and buyers implement systems of prompt payment, ensure transparency across their suppliers of who is paid when, and create predictability and access to timely capital for small businesses. Although it is a short-term funding solution, it can help businesses manage cash flow for their operational needs and help stimulate growth.

SCF is used extensively outside of the US, particularly in Latin American markets. This is primarily an outcome of the developments in electronic tax invoicing, which allowed for e-invoicing to be used in different segments of the economy, enabling SCF to take root, given standardized and verifiable documentation of transactions for which credit can then be extended. Latin American countries hold a significant proportion of the trade finance market, but over half is concentrated in the Asia-Pacific markets. China in particular has a strong influence on SCF not just due to their large trade activities globally, but as a result of their technological capabilities in the digitisation of SCF. Within Africa, overall SCF activities were negatively affected by the banking regulations following the global financial crisis, but there is a lot of opportunity in the market following the signing of the African Continent Free Trade Agreement (AfCFTA). There is also room to adopt more integrated practices within European markets, with regard to legal frameworks as well as the limited uptake with digitization. Despite all these global developments, 80% of eligible assets in the market remain untapped, with an estimated global trade financing gap of $1.7T. This is where non-banking players such as FinTech have come in to try to fill the gap in the market, but there is still substantial work to be done to provide capital to the companies that need it the most.

SCF is often used for cross-border transactions; in these cases it is often referred to as trade finance. Historically there has been significant confusion around the terminology surrounding SCF. The Global Supply Chain Finance Forum has been created by a number of industry associations to create a standard language for stakeholders and establish best practices. As much as possible, we have used their language and definitions in this chapter.

FAQ

It depends on the technique used. In an early payable case, the cost represents the discount the seller provides for receiving an early payment for its goods/services. In a receivables purchase case, the cost is the fee that the financial provider charges to deliver an advanced payment on the corresponding invoice, which can vary from 3% to 5%. Finally, in a loan case, the cost would be the corresponding interest rate payable on the loan, which can vary depending on the funding provider ranging from 15% to 25%.

SCF can strengthen the relationship between buyer and supplier, since the buyer may be able to negotiate longer payment terms or price discounts with its suppliers and thereby improve its own working capital position.

Furthermore, SCF offers high-quality transaction-based short term financing based on the credit of a primary buyer and supporting the business objectives of both trading parties.

SCF can also be a tool to drive racial equity by supporting local diverse businesses and strengthening local supply chains. Efforts to re-shore production in light of global supply chain disruptions and concern over racial inequities have converged on SCF as an ideal tool to channel local purchasing and demand toward long overlooked BIPOC-owned firms.

SCF solutions could help globally by offering alternatives to cover increasing upfront costs for production.

World inflation has been increasing consistently due to production costs and energy prices. Moreover, climate change effects such as floods and droughts have increased food insecurity which further threatens the sustainability of food production systems by destroying lands, livestock, crops, and food supplies. Finally, The war in Ukraine and sanctions on Russia are disrupting shipments and production delivery of nearly 30% of world wheat exports and 18% of corn.

Finally, there are opportunities to use SCF with a climate, gender, racial equity or development lens to address global crises and structural inequities within our current financial system.

Deeper Dive

Capital Product Fit

When is SCF a good fit for businesses?

- Bridging: It should be used to bridge a cash gap or allow companies to maximize production capability to scale.

- Profitability: SCF changes the timing of payments, not the underlying economics of the company, so companies need to either be profitable or have the reserves necessary to fund any overall loss for the company.

- Seasonality: Seasonal businesses or those that have significant spikes in demand are good candidates for SCF.

- Procurement: For large public and private contracts with formal procurement processes, suppliers without documentation or track record to prove they are financially trustworthy enough to deliver the contract will be excluded from the bidding competitive process. This includes smaller providers and those historically underserved by traditional financial institutions, including Black-, Brown-, minority- and/or women-owned businesses.

When is SCF not a fit for businesses?

- Long Term Financing: At a foundational level, SCF is primarily a short term source of cash flow for a business for its operational needs. It does not solve core financial issues that a business may find affecting its balance sheet.

- Complexity: SCF shifts forward the timing for companies to receive payments. If the company’s financial team does not account for this shift, the company might not be able to cover their costs in a given month. This means that finance departments of small businesses need a level of sophistication; they must perform sophisticated forecasting and planning to account for the variations in cash flow.

- Personal guarantees: When funders request a personal guarantee, founders might need to evaluate the risk that this represents to them when considering signing a funding agreement.

Why would founders want to choose SCF?

- Timing: When founders want to access timely working capital secured against future orders.

- Affordability: If the cost of SCF is affordable compared to alternative funding options.

- Opportunity: When the profit from a sales or procurement opportunity is higher than the cost of SCF.

- Customer size: When founders have large customers with a good track record in terms of purchases.

What should businesses look out for with SCF?

- Cost: SCF can be predatory in its pricing. For many companies this is the only option for financing for a large project, so they may be inclined to pay exorbitant fees. There exists a need for affordable SCF for small suppliers.

- Fit for Purpose: Because SCF is a form of short-term financing, when used over periods longer than a few weeks or months, it can become expensive for businesses.

- Guarantees: If personal guarantees are requested by funders and the risk is considerable.

- Timing: As SCF moves payments forward, sometimes prior to the delivery of the goods and services, the complexity of accounting may increase. Companies will need to ensure their accounting team accurately records and forecasts payments against expenses.

Types of Agreements

As discussed above, there are three distinct categories of SCF agreements: advanced payable, receivables purchase, and loans. In essence, businesses can negotiate an early payment from a customer, sell their receivables, or borrow against them.

Within each of these categories, payments can be made using invoices (i.e. paid after the goods have been delivered) or purchase orders (i.e. paid before the goods have been delivered).

Advanced Payable

Early payment of an invoice or purchase order. This is a buyer-led program where sellers in the buyer’s supply chain can, at their option, access liquidity by receiving a discounted early payment.

This early payment can be completed using invoices or purchase orders. The cost of the financing should reflect the risk of the transaction and the cost of capital for the buyer. As discussed previously, the risk to buyers of an invoice based advanced payable transaction is effectively zero, thus the cost to the suppliers should reflect the cost of capital for the buyer and the administrative cost of the program. For buyers with excellent credit records and thus the ability to access capital cheaply, the delta between their financing cost and their suppliers’ financing cost will likely be considerable. This represents a significant opportunity for large buyers, including corporations and governments, to create affordable supply chain financing programs that leverage their low cost of capital.

For purchase order-based advanced payable transactions, there does exist execution risk on the part of the supplier, so the cost of financing should reflect this risk.

Many of the buyer-led options with early payments that can be used in this case include Corporate Payment Undertaking, Dynamic Discounting, and Bank Payment Undertaking.

Receivables Purchase

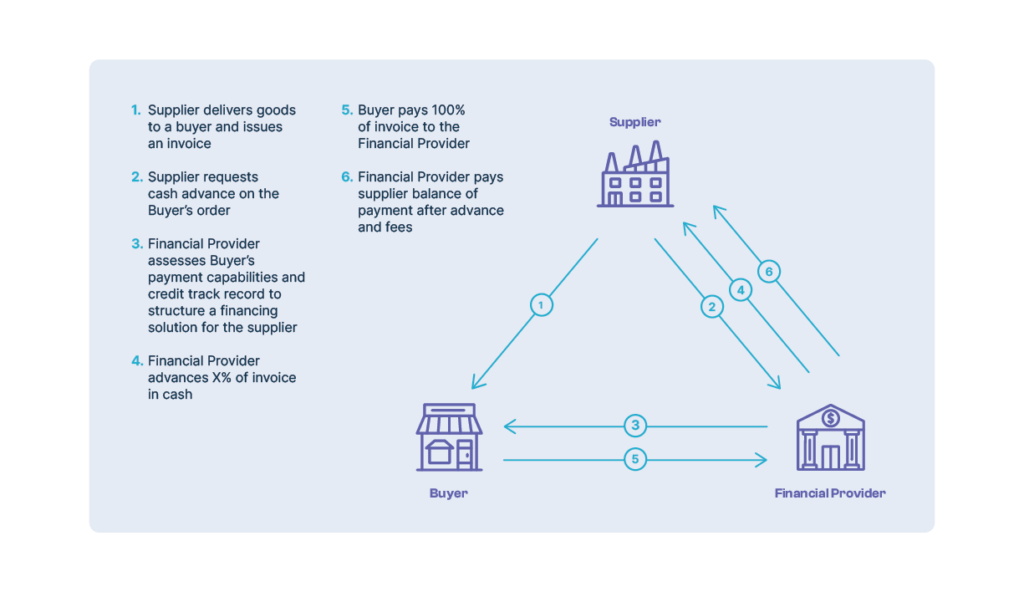

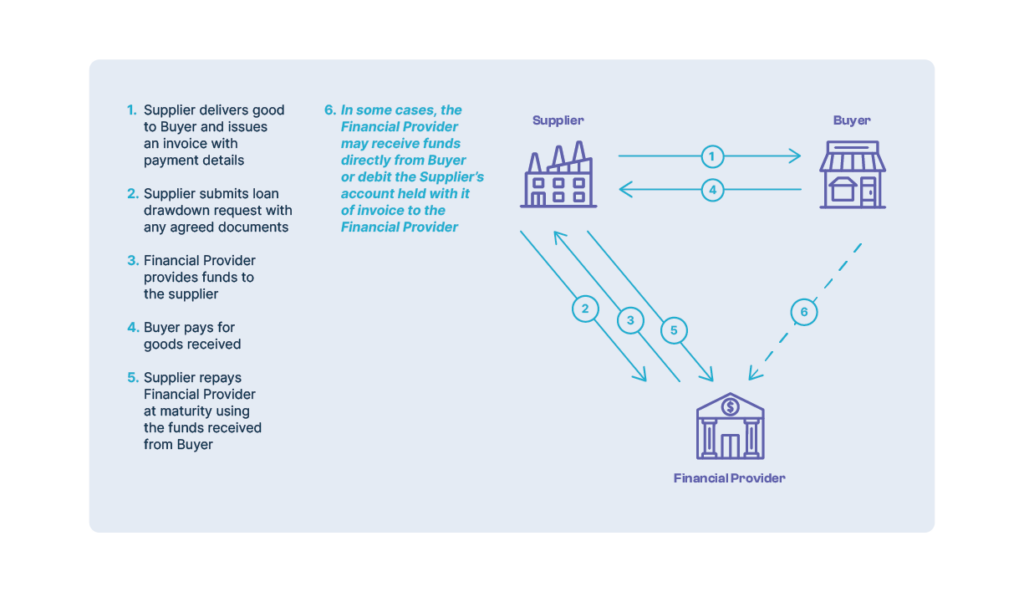

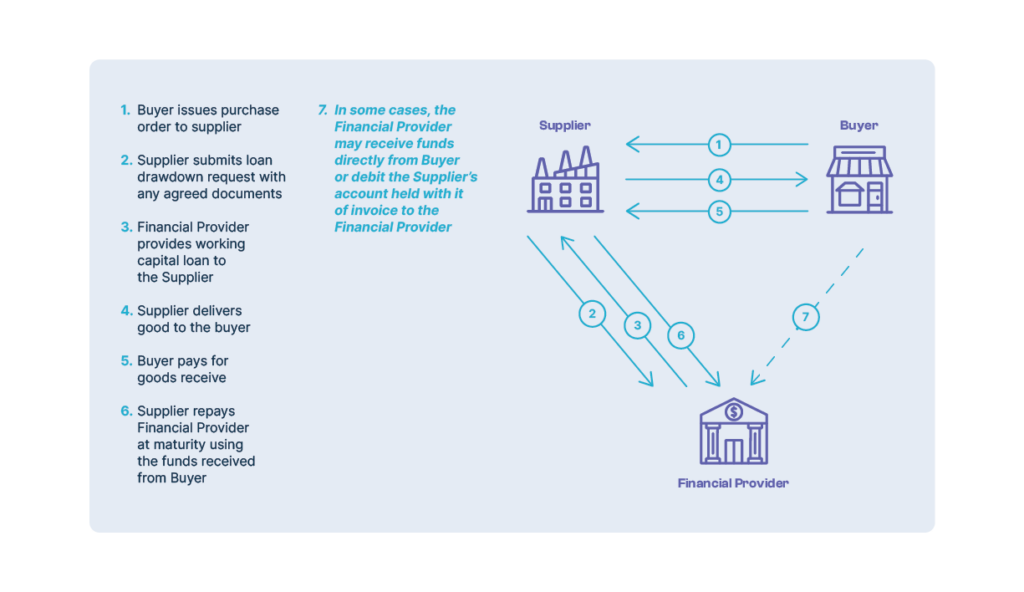

A receivables purchase is an agreement between a finance provider and a client (supplier) to fund the purchase of an individual or a portfolio of receivables in order to receive cash flow advancement to fund working capital needs. Unlike an early payable arrangement which is buyer led, a receivables purchase is a financier-led program where there is funding against invoices or purchase orders as a form of collateral.

In this case, a supplier generates a purchase order or invoice for the buyer and a financial provider comes in as a third-party to finance the supplier’s purchase order or invoice based on the buyer’s credit quality. This allows the financial provider to obtain the final payment from the buyer once the supplier fulfills their obligation or has reached the payment term. The financier can then claim their fee, and return the rest of the proceeds to the supplier. This form of financing often includes Forfaiting, Factoring, Receivables Discounting and Payable Finance.

Loan

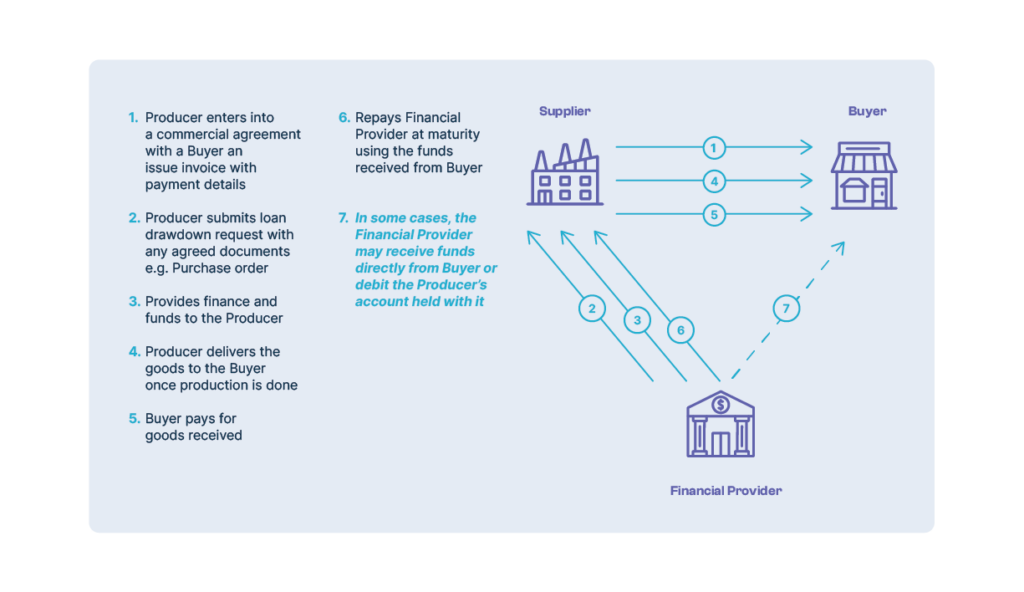

Loans make money available to another party in exchange for future repayment of the principal amount with interest or other finance charges. A loan may be for a specific, one-time amount or can be available as a variable credit line or overdraft up to a specified ceiling amount. It is also possible to make loans of actual real and financial assets.

While a loan can take many forms, there are some similarities in the mechanics of a receivables purchase, except loans often rely on the credit quality of the supplier as opposed to that of the buyer. These include loans against receivables, distributor finance, loans against inventory and pre-shipment finance.

U.S. Landscape

- Currently underdeveloped market: The US’s supply chain finance landscape is underdeveloped compared to peer, OECD economies; the SCF industry is generally limited to one-off financier-led arrangements, with few systematized or even buyer-led arrangements.

- Lack of standardized, e-invoicing: A significant reason for this country’s limited SCF options stems from its lack of electronic invoicing. “E-invoicing” is widely used elsewhere and even mandated across many nearby Latin American countries. Standardized e-invoicing provides confidence to third-party financial institutions that contracts are legitimate and easily transmitted, creating a market for SCF.

- Innovations in public procurement: Large public purchasers in Los Angeles — LA World Airports, LA Metro, the City, and the County — are innovating to create economies of scale across their organizations and underwriting against their promise of payment, with a dedicated funds administrator, to create lower cost of funds and directly connect contracts to capital.

- LA’s Contract Finance Assistance Program, as reported here (specific programs: Los Angeles World Airports; City of LA), directly connects public contracts to financing via a dedicated third-party funds administrator.

- New York State’s Bridge to Success Loan Program creates short-term bridge loans that boost the ability of Minority/Women-owned Business Enterprises (MWBEs) to participate in state contracts. This program helped the state double MWBE contracting between 2011 and 2013 in conjunction with the state’s Bond Guarantee Assistance Program, supported by State Small Business Credit Initiative funds from the federal government.

- Recent initiatives: In 2015, the US Office of Management and Budget called for all-electronic invoicing for all federal procurement by 2018, detailing inefficiencies of paper invoicing for the US government’s 19M invoices per year: the difficulty of managing mixes of digital and manual processes; $266M in annual federal government savings from a transition to all-electronic processes; and concomitant business costs and losses from slow payment to suppliers, with the average paper invoice costing $10 and taking 10 days to manually process. The federal mandate appears to have gone into effect with little fanfare. Whether e-invoicing will be widely adopted by the private sector or state and local governments remains to be seen, and is the subject of an ongoing project of the Federal Reserve Banks.

- While the FedPayments Improvement program has focused recently on topics such as digital currency and peer-to-peer payment (e.g., Venmo), the group looks to implement a document exchange by 2023, to modernize US B2B payments, potentially facilitating the growth of an SCF US market.